starting credit score canada

Getting a newcomer credit card is a great way to start building your credit score in Canada. Here are ten steps you can take to increase your credit score and work toward financial independence starting with simply knowing what your credit score means.

600 Credit Score Is It Good Or Bad

Two national credit bureaus operate in.

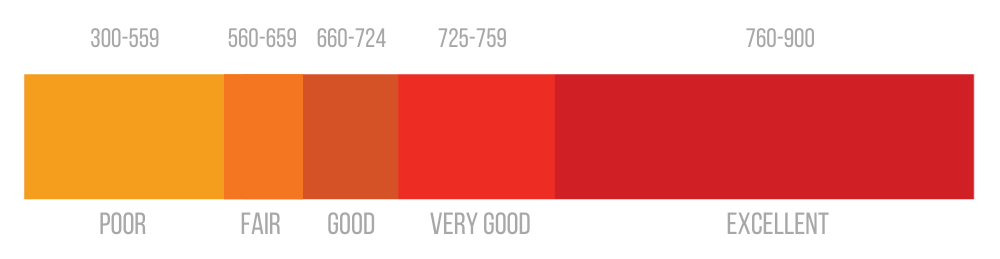

. It shows how well you manage credit and how risky it would be for a lender to lend you money. As soon as you swipe your credit card for the first time your credit card provider utility companies and any other creditors will begin reporting your behaviour to the big credit bureaus. 725 to 759 is very good.

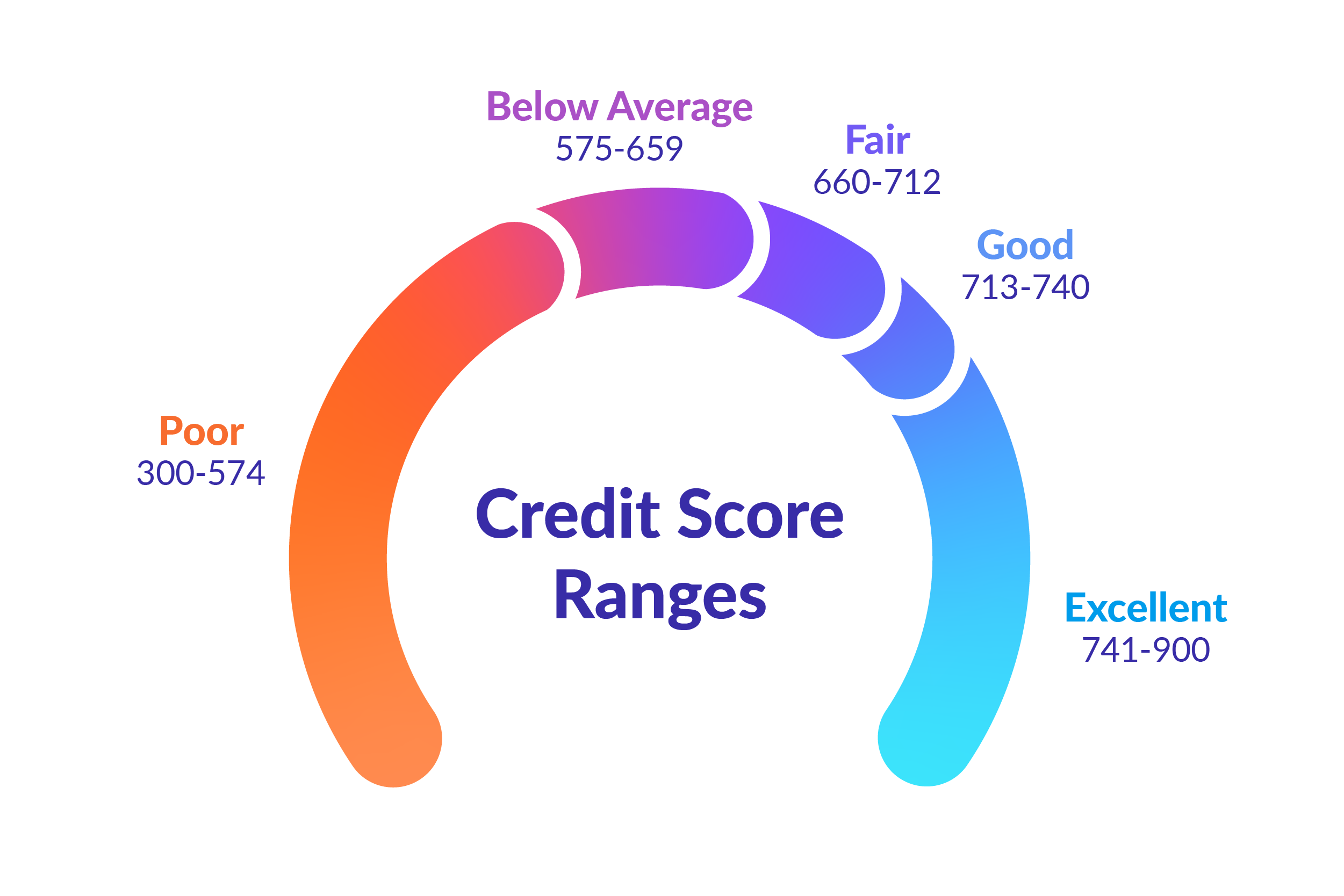

Canadian credit scores vary between 300 to 900 and represent your likelihood to repay debt on time. The higher your score the better credit rating you have. A good credit score in canada is typically one that is 680 or higher.

A credit score is essentially a numeric rating that banks lenders use to qualify you for a loan. Newcomers without a credit score or credit history can apply. Some benefits of newcomer credit cards include.

1 What is a credit score in Canada. There are five distinct categories that your credit score could fall into ranging from poor to excellent. Your credit score comes from the information in your credit report.

If youve never had credit activity a credit card or loan or instance you wont start at 300. As soon as you swipe your card for the first time your credit card provider utility companies and any other creditors will begin reporting your behaviour to the big credit bureaus. Your credit score is a number between 300 and 900 that tells lenders in Canada how trustworthy you are as a borrower.

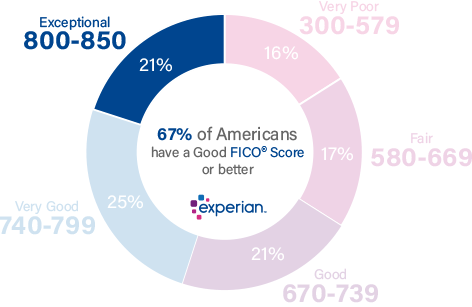

On average Canadians within the youngest age bracket 18 25 have a credit score of 692 while the oldest 65 have a credit score of a little over 740. Your Credit Score Doesnt Start at Zero. You can access your credit score online from Canadas 2 main credit bureaus.

This means that you can start establishing a good credit score simply by paying your bills like your internet or mobile phone bill on time. What is a credit score. Only range from 300 to 850.

Having a good credit score can help you qualify for financial products at lower interest rates. Your credit score is a three-digit number between 300 and 900 that represents your credit risk. Your credit score will be used by lenders and others to determine whether or not you qualify for.

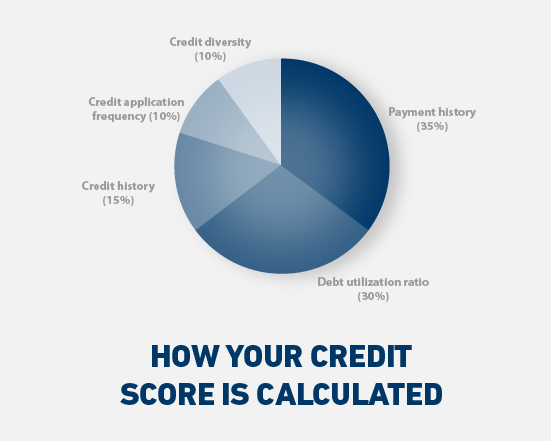

Credit scores are generally something between 300 and 900. Know What Your Credit Score Currently Is. Thats because your credit score is calculated only at the moment that a lender credit card issuer or other entity requests it to check your creditworthiness.

Within about six months these bureaus will have enough data on you to fill out a credit report and calculate your first credit scores. A good credit score in Canada is any score between 713 and 900. To Canada or vice versa.

Credit risk is the likelihood youll pay your bills on time or pay back a loan on the terms agreed upon. The following credit score ranges from Equifax show what credit score ranges are considered good. Although these arent huge differences in retrospect they do make things more complicated if youre trying to transfer your credit report from the US.

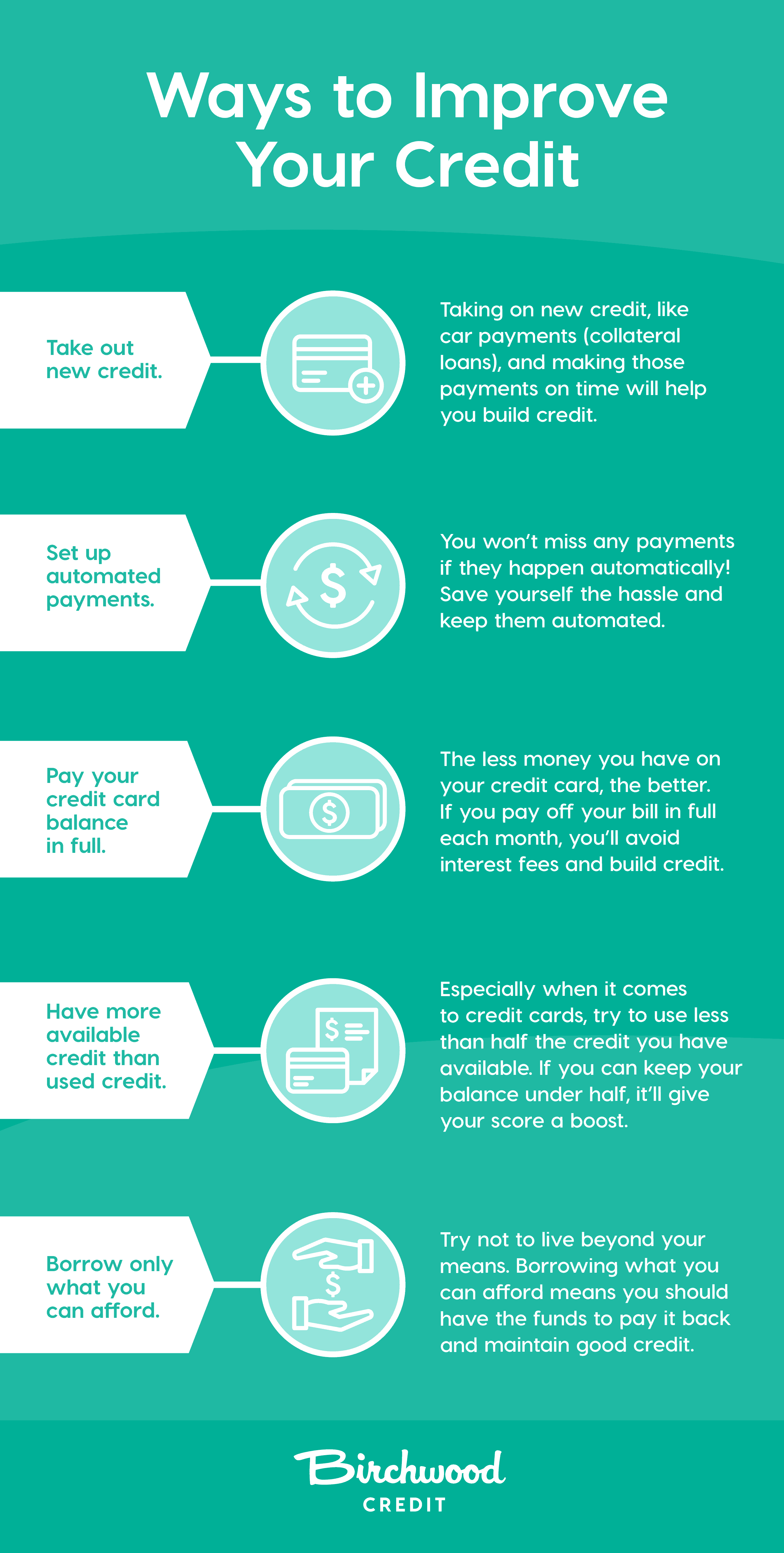

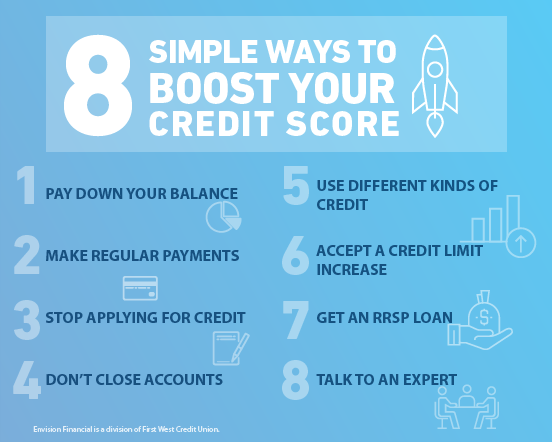

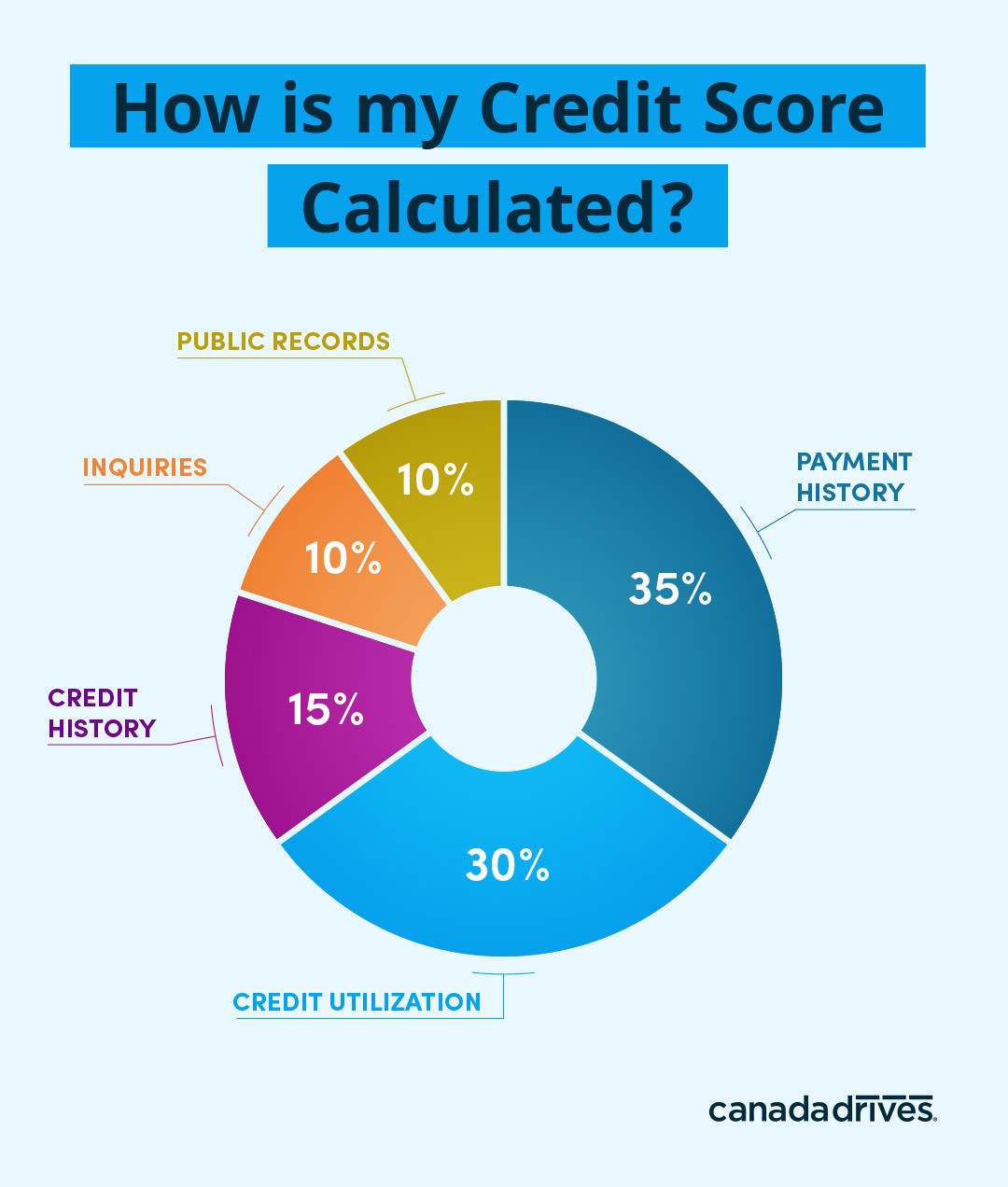

Learn more about how your credit score is calculated. In Canada credit scores range from 300 very poor to 900 excellent with the average Canadian credit score sitting at 650. Credit scores in Canada range between 300 and 900.

Once you open other accounts like credit cards loans or a mortgage every on-time payment will contribute to boosting your score. What is the credit score range in Canada. 660 to 724 is considered good.

Canadian credit scores range from 300 on the low end to 900 on the high end whereas credit scores in the US. Get your credit score. Your credit history begins when you open your first credit card and it will take about six months for the major credit bureaus to gather enough data to calculate your initial score.

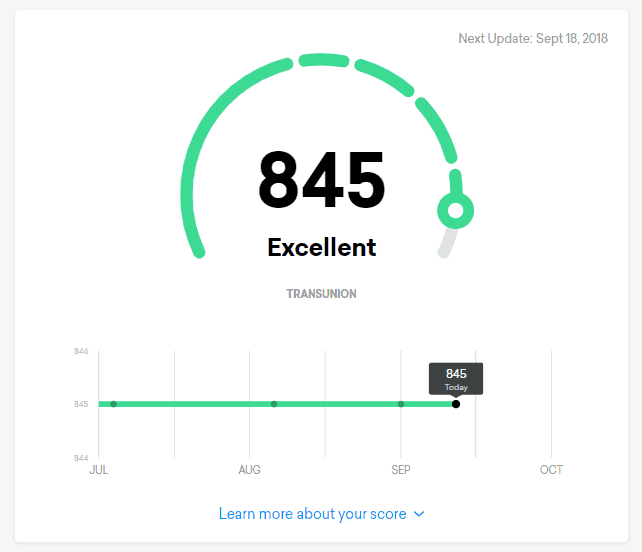

Your credit score from Equifax is accessible online for free and is updated monthly. Within about six months these bureaus will have enough data on you to fill out a credit report and calculate your first credit scores. Also understand what determines your credit score because that will vary country by country.

In Canada you will get credit scores as high as 900 points as a simple starting point. Data also shows that as age increases so does the average credit score number. It shows how risky it would be for a lender to lend you money.

There are simple ways to build your Canadian credit score like applying for a secured credit card or getting a cellphone plan. Results in 2 Weeks Add 2 Years Past History Today. Rather your score simply doesnt exist.

Your credit score is calculated using a formula based on your credit report. Credit scores range from 300 just getting started 650 the magic middle number which will likely qualify you for a standard loan all the way up to 900 points the highest score. What is a good credit score in Canada.

760 and above is excellent. In TransUnions view a score that is above 650 will likely allow you to receive a standard mortgage loan while a score that is below 650 is likely to block you from receiving new credit insurance. Starting with no credit score doesnt mean your score is zero.

In Canada your credit score refers to a three-digit number usually between 300 and 900 that indicates your creditworthiness In other words its a kind of report card on how good you are at managing debt and financial responsibility. No security deposit is required unlike in the case of secured credit cards. In Canada credit scores can be as high as 900 and as low as 300 but dont worry.

Your credit score is a three-digit number that comes from the information in your credit report.

Can You Get A Car Loan With A 600 Credit Score Hot Sale 52 Off Www Ingeniovirtual Com

What Is A Good Credit Score Forbes Advisor

Credit Score Range What Is The Credit Score Range In Canada

What S Considered A Good Credit Score Transunion

What S A Good Credit Score Range Do You Know Yours Finder Canada

Understanding Your Credit Score And Why It Matters Envision Financial

12 Best Loans Credit Cards For 400 To 450 Credit Scores 2022 Badcredit Org

How To Improve Your Credit Score Lendingtree

The Ultimate Guide To Credit Scores In Canada Borrowell

Understanding Your Credit Score And Why It Matters Envision Financial

How To Build A Good Credit Score In Canada Arrive

What Is The Average Credit Score In Canada By Age Loans Canada

What Is The Average Credit Score In Canada By Age Loans Canada

Credit Karma Canada Review 2022 Free Credit Score And Report

Understanding Your Credit Score And Why It Matters Envision Financial

800 Credit Score Is It Good Or Bad

Everything You Need To Know About Credit Scores Canada Drives